IP Delivery Driving Continued Globalisation

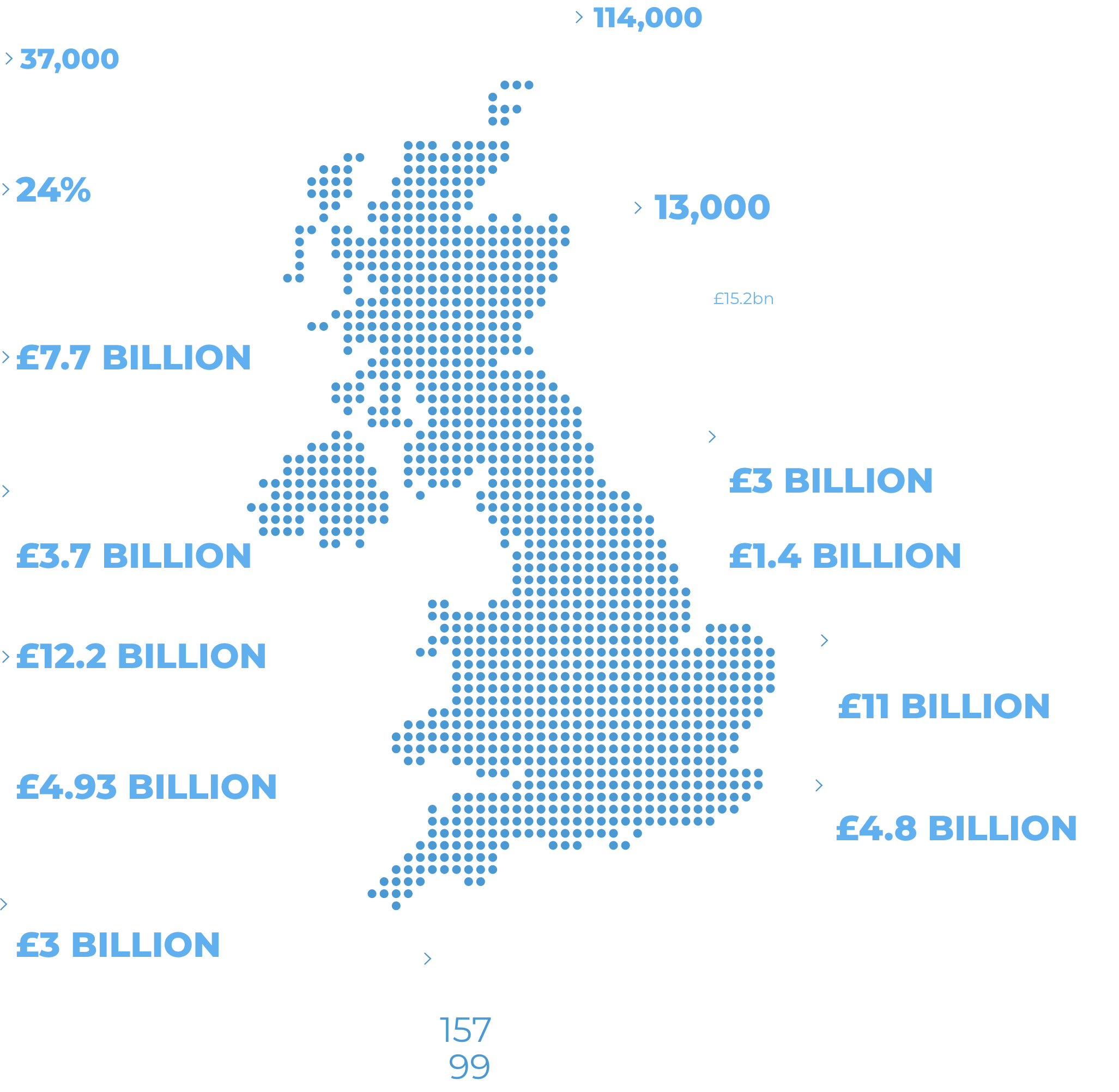

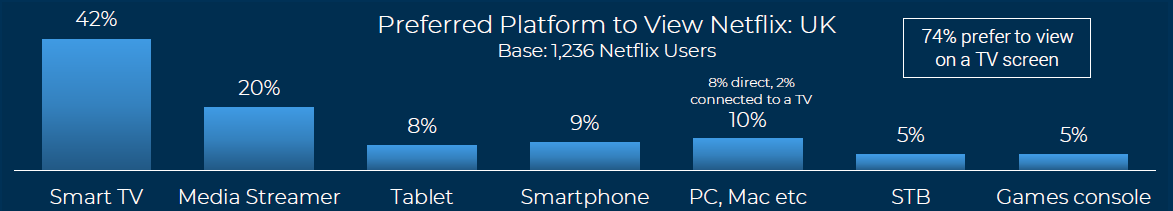

As discussed, the major underlying trend in UK television currently is the shift to IP-based delivery. This shift has brought with it both significant opportunities and challenges for existing companies the UK digital television landscape and manifests itself across the value chain; from how content is produced and for whom it is produced, to the means by which content is delivered and which services and devices consumers are using . This key trend has driven notable shifts in the competitive landscape for wider TV and viewing, providing a huge increase in consumer choice. One major area of change has been the growth in viewing content on global services. Netflix has spearheaded this from a paid-for, premium content perspective, whilst YouTube and other social media platforms have driven largely free, short form content viewing.

Global services such as Netflix drive global hits whilst many other services are supporting significant niches.

Leading services such as Netflix and Amazon Prime are also supporting local UK production and fuelling significant investment in local production facilities

This globalisation is also providing an increased opportunity for international exploitation of UK-produced content.

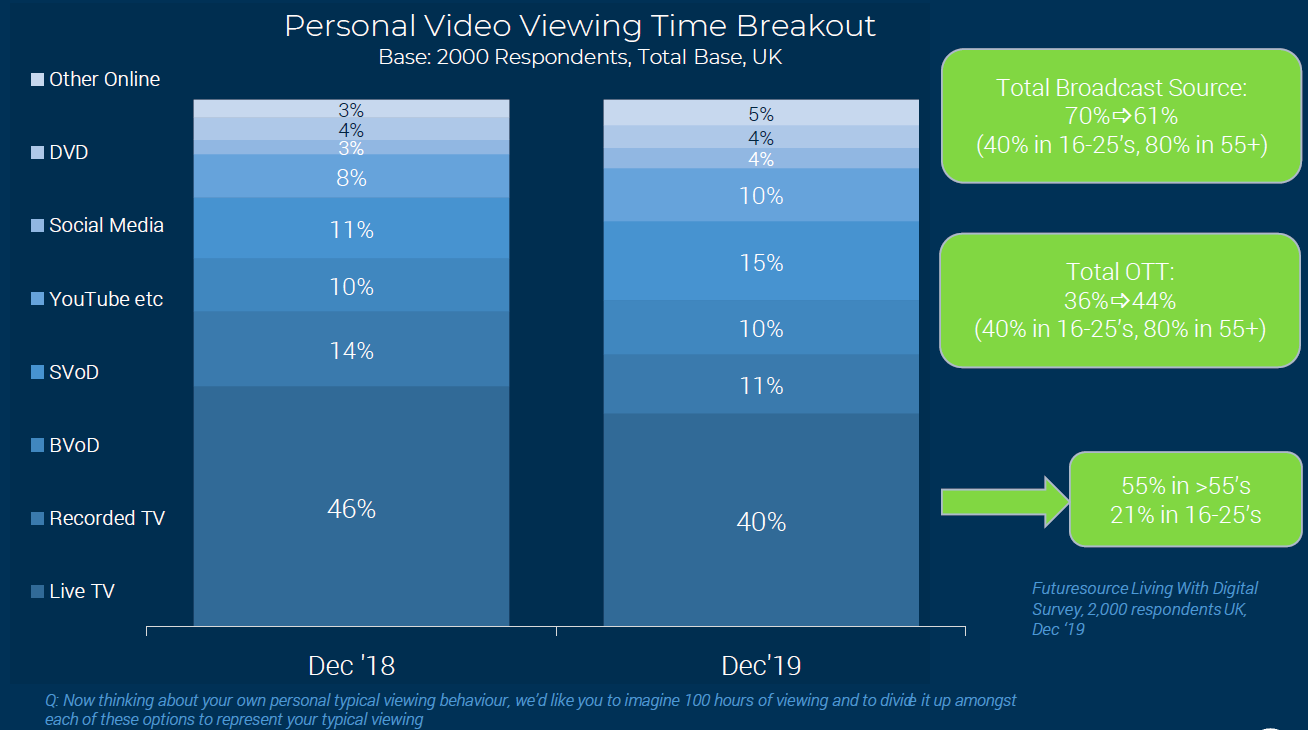

Futuresource estimates that 90% of all SVoD subscriptions are from US based services. SVoD accounted for 15% of total UK viewing at the end of 2019, which is expected to continue to grow in 2020 and beyond, meaning that US based services are set to take an increasing proportion of all UK video viewing moving forwards, diluting UK broadcaster’s share of viewing.

SVoD accounted for 22% of all Video Viewing in USA in Dec 2019, up from 18% one year prior. This points to over 20% of all viewing in UK to be SVoD by the end of 2021

A new era of global Direct-to-Consumer (D2C) services from Disney, Apple, NBC Universal etc also complements existing local broadcaster led D2C services. This growing fragmentation is driving the increased requirement for Super Aggregators, providing seamless search, navigation and potentially billing across multiple services

Existing Pay-TV services & telcos can fill the role, but are now confronted by global giants such as Apple, Amazon, Google, and Facebook.

These global D2C services also give rise to a new Pay-TV paradigm, whereby traditional content and channel carriage arrangements are being superseded by app carriage and integration, heralding a new commercial era.

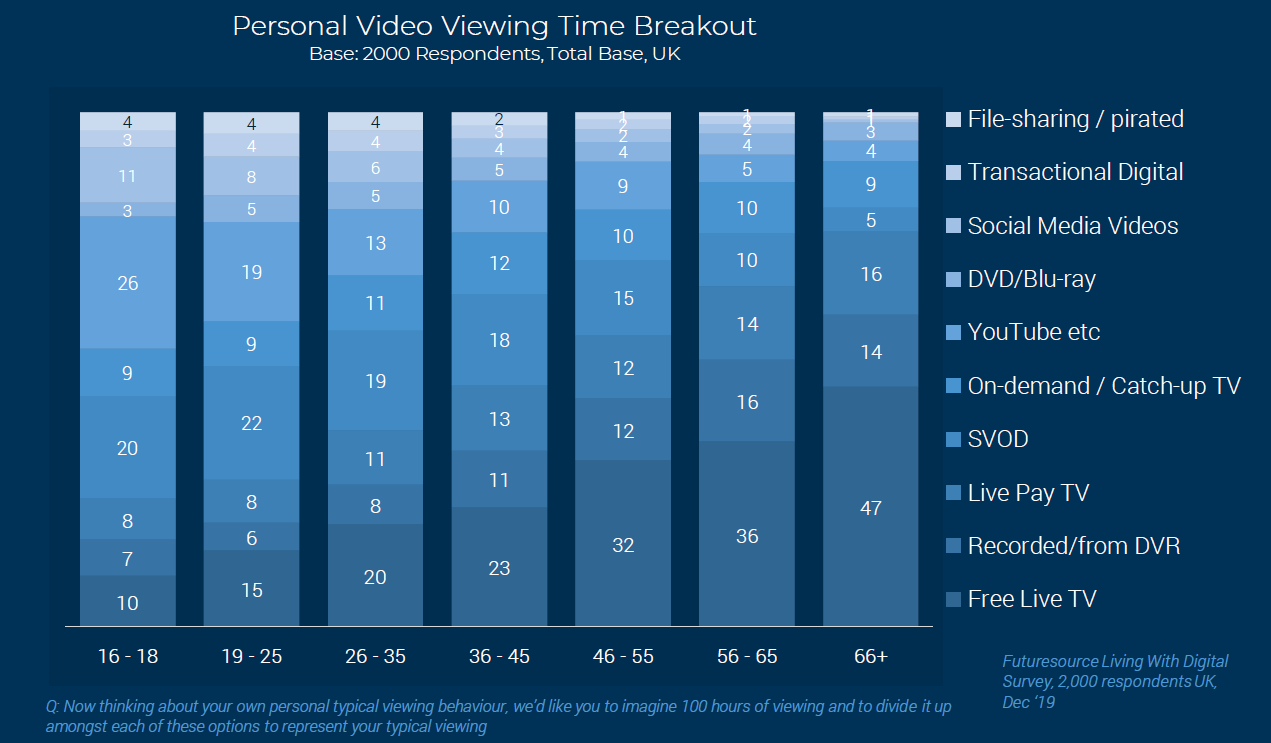

Growth in such services has also driven a steadily shifting mix across all viewing towards platforms, amongst all demographics.

National broadcaster audiences will continue to be challenged by global services, particularly D2C services, which has seen them diversify their offerings and in the case of commercial broadcasters, revenue streams. Increased investment in addressable TV, D2C services, production and domestic and international licensing of their content is already evident. This investment will be partly be impacted by COVID-19, but is required to offset a decline in traditional broadcast advertising revenue for these broadcasters.

UK BVoD Services Continue to Impress

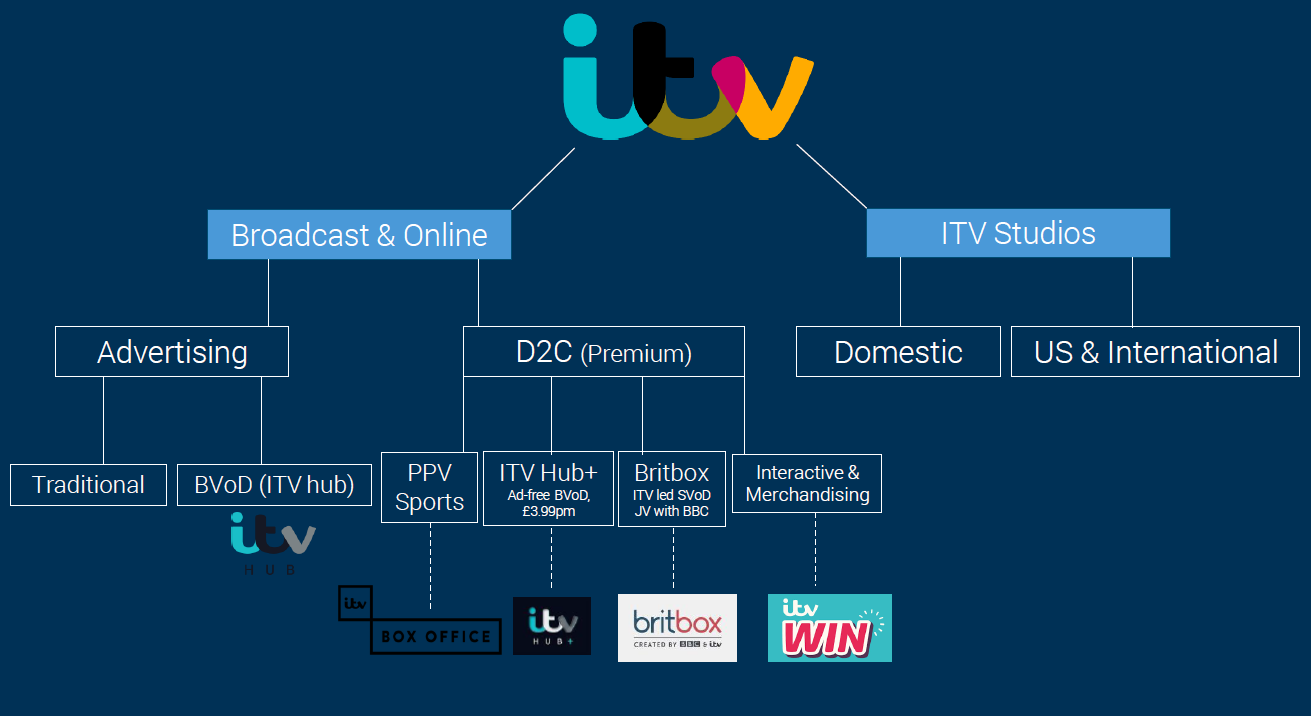

Whilst global services take an increased share of overall viewing time, UK based broadcaster VoD services continue to show impressive growth, with BBC iPlayer request growing by 12% in 2019 to 4.4 billion and ITV Hub reaching 32 million in Q1 2020, a year-on-year increase of 13%.

The UK is one of the pioneers in broadcaster VoD (BVoD) worldwide, with Channel 4 launching the first ever BVoD service worldwide in 2006. Despite services being well established, features, experiences, user bases and engagement continue to evolve and improve. Share of viewing will steadily increase in coming years as existing features become more established and new features emerge, encouraging new user uptake and increased engagement. BBC iPlayer added new features such as live restart and significantly increased the length of time most content is available on the platform, to typically one year after original broadcast.

2019 saw further emphasis on ad-free, subscription based BVoD services as broadcasters look to diversify their revenue streamers, with ITV driving this sector. ITV saw good growth in the ITV Hub+ ad-free SVoD service in 2019, which now has over 400k subscribers, whilst Channel 4 also launched a similar service.

ITV also spearheaded the launch of Britbox (which it has a 90% controlling stake, with BBC also a shareholder) in November 2019, which is designed to complement both the free and paid-for BVoD offerings.

Sports Broadcast a Hotbed for UK Innovation, as Global Players Arrive

The sports viewing evolution is also set continue as globalisation starts to influence the sector, with IP delivery driving increased availability of live sports programming and both enhanced and personalised viewing experiences. Sports broadcast has been a particular hotbed of innovation in recent years in the UK, driven by the rights competition amongst leading players. Sky Sports and BT Sport in particular have been influential in driving this innovation and impressive customer experiences.

The sports broadcast landscape has begun to change, with the availability of a wider range of sports programming across multiple services, including some D2C services. Globalisation of sports services is at a much less advanced stage than traditional programming, largely due to local rights fragmentation, but the recent successes of Amazon are illustrative of further expected moves by global players. DAZN was set to launch in the UK although this has been postponed due to the COVID-19 pandemic.