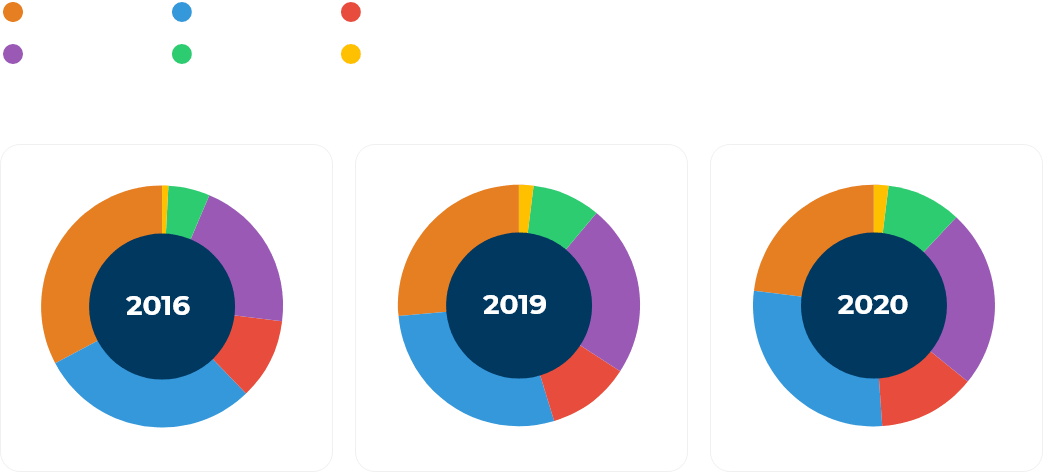

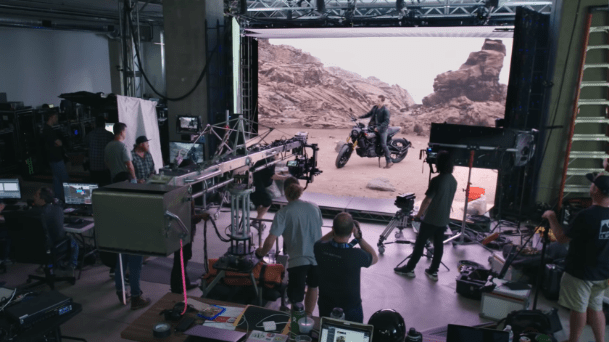

EXECUTIVE SUMMARY

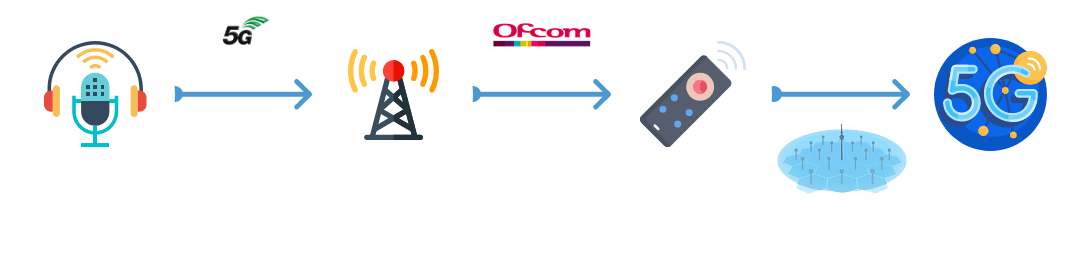

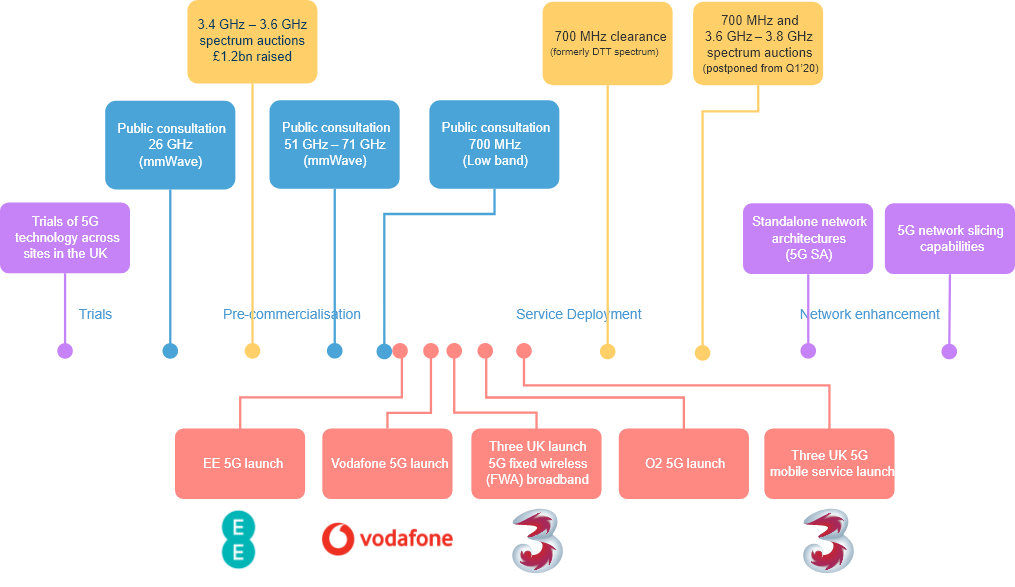

The UK television industry remains at the forefront of broadcast technology and digital television innovation, despite the challenging global circumstances. UK companies have continued to provide world “firsts”, building on previous notable achievements in the digital television landscape, further enhancing consumer experiences.